Roll over 401k to roth ira tax calculator

Ad Compare your matched advisors for fees specialties and more. 4 Steps to Roll Over a 401 k to an IRA.

What Is The Best Roth Ira Calculator District Capital Management

Heres how it works.

. You will save 14826875 over 20 years. The easy answer to your second question is again yes you can potentially contribute to a Roth IRA even if you contribute the yearly maximum to a 401 k. Your actual qualifying contribution may.

Lets assume Andrew is age 60 retired and has 1 million in his 401 k. Roth Conversion Calculator Methodology General Context. Answer A Few Simple Questions To Find Out Which IRA Make Sense For You.

You can either choose a traditional IRA or a Roth IRA. The terms of a registered pension plan that detail the specific amounts that an employer and employee contribute to the plan. When you convert from a traditional IRA to a Roth IRA the amount that you convert is added to your gross income for that tax year.

Your IRA could decrease 2138 with a Roth. Ad Compare your matched advisors for fees specialties and more. Ad Roll Over Funds From Your Old Retirement Account To A TIAA IRA.

Open a new IRA or choose an existing one. The amounts may be. Does Max Contribution To 401k Include Employer Match.

If youre looking to roll your traditional 401 k into a Roth IRA the taxes youll need to pay will be calculated based on your income. The Roth 401 k allows contributions to a 401 k account on an after-tax basis -- with no taxes on qualifying distributions when the money is withdrawn. Ad Get Help Rolling Over Your Old 401k Account to a Fidelity IRA.

Lets look at a hypothetical example of a 401 k rollover to a Roth IRA. Schedule a call with a vetted certified financial advisor today. It increases your income and you pay.

Rollover IRA401K Rollover Options. If you are in a 28000 tax bracket now your after tax deposit amount would be 300000. The IRS uses marginal tax brackets to decide.

The Roth Conversion Calculator RCC is designed to help investors understand the key considerations in evaluating the conversion of. This calculator compares two alternatives with equal out of pocket costs to estimate the change in total net-worth at retirement if you convert your per-tax 401 k into an after-tax Roth 401. For some investors this could prove.

In 2022 the income phaseout range for taxpayers making contributions to a Roth IRA increases to. This convert IRA to Roth calculator estimates the change in total net worth at retirement if you convert a traditional IRA into a Roth IRA. Ad Get Help Rolling Over Your Old 401k Account to a Fidelity IRA.

How to Rollover a 401K. All youll have to do is follow the same steps as if you were rolling over a traditional 401. How To Calculate 401k Match.

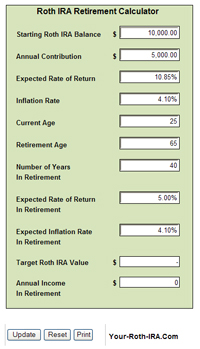

Roth IRA Rollover Calculator Use this Roth IRA rollover calculator to project the inflation-adjusted after-tax value of your Traditional IRA or 401k at retirement versus the inflation-adjusted tax. Roll Over 401K To Roth Ira Tax Calculator A gold IRA or protected metals IRA is a Self-Directed IRA where the owner maintains ownership of the accounts receivable and the. Use our Roth IRA Conversion Calculator to compare estimated future values and taxes.

For the phaseout begins at 198000 with an overall limit of 208000. Check out our video on the Backdoor Roth IRA technique. In fact its an ideal retirement.

If youre looking to do a rollover from a Roth 401 to a Roth IRA the process is quite simple. Schedule a call with a vetted certified financial advisor today. Decide on the type of IRA you want.

Traditional Vs Roth Ira Calculator

Roth Ira Calculator Roth Ira Contribution

Roth Conversion Q A Fidelity

401k Rollover Calculator To Roth Traditional Sep Or Simple Ira

Roth Ira Calculators

Traditional Vs Roth Ira Calculator

Roth Ira Calculators

Roth Ira Calculators

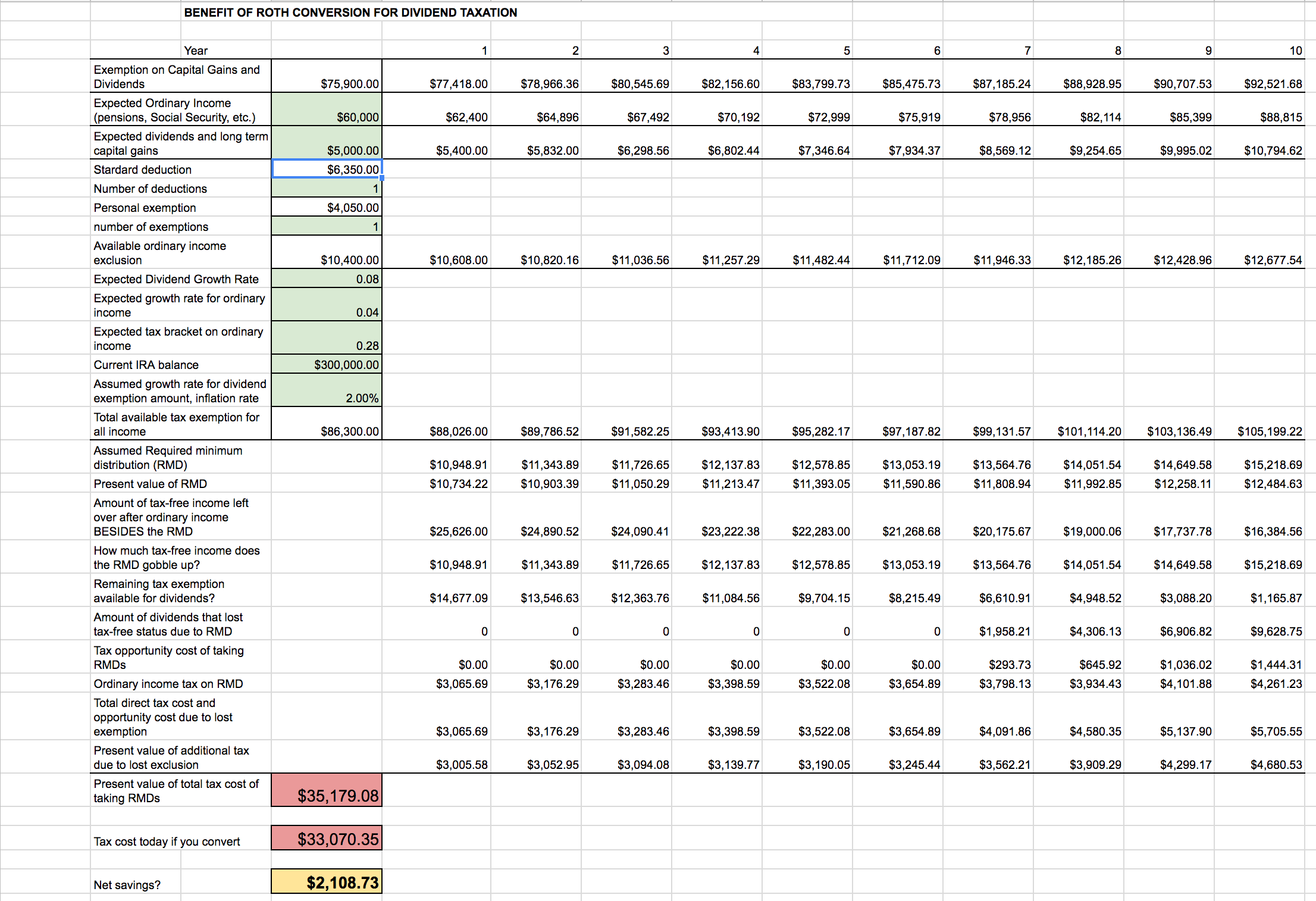

Roth Ira Conversion Spreadsheet Seeking Alpha

What Is The Best Roth Ira Calculator District Capital Management

Using Online Calculators To Choose Between Traditional And Roth Iras The Cpa Journal

Using Online Calculators To Choose Between Traditional And Roth Iras The Cpa Journal

Using Online Calculators To Choose Between Traditional And Roth Iras The Cpa Journal

Roth Ira Conversion 2012 Roth Calculator For Ms Small Business Owner Marotta On Money

Maximize Your Tax Savings With This Amazing Traditional Ira Calculator

Using Online Calculators To Choose Between Traditional And Roth Iras The Cpa Journal

Roth Ira Calculators